by Taxing Subjects | Aug 5, 2023 | Tax Tips and News

The Internal Revenue Service says it has constructed a blueprint for its future called the Paperless Processing Initiative. The plans are aimed at eliminating up to 200 million pieces of paper every year, while cutting processing times in half and speeding up refunds by weeks. The agency says it will realize these benefits by fully embracing digital filing and processing – the sooner, the better. The plan is a two-step process with work starting now and extending past filing season 2026. It’s funded by the Inflation Reduction Act.

When it comes to speeding up the taxpaying process, paper is the enemy.

Every year, the IRS gets about 76 million paper tax returns and forms, and another 125 million pieces of correspondence. Each one of those pieces of paper requires a human being to enter its information into the IRS computer systems.

This process can lead to a filing logjam as outside of the annual 1040 tax return and a relatively few other forms, taxpayers are currently limited to sending in forms and correspondence to the IRS on paper. Meanwhile, the agency can’t digitally process the mountain of paper it gets. In fact, just storing the paper returns and correspondence the agency receives costs a tidy $40 million every year. The plan is to push all tax filing into the digital world, and to devise a system to automatically scan any paper documents on arrival.

Step One: Taxpayers Can Go Paperless in Filing Season 2024

The first step is a big one in itself: taxpayers will be able to send all their correspondence, non-tax forms, and notice responses to the IRS in digital form. This may appear to be a small action, but it will take millions of paper documents out of the processing backlog every year. The IRS estimates that this initial step alone will mean some 94% of individual taxpayers will no longer ever need to send a piece of mail to the agency.

Some 20 additional tax forms, meanwhile, will be added to the digital availability list. This will include amendments to Forms 940, 941, and 941SSPR. The most popular non-tax forms – at least 20 of them – will also be moved over into the digital world and optimized for mobile devices. This includes the Request for Taxpayer Advocate Service Assistance.

Note, however, that in this first phase taxpayers who have a need to file a paper form or send paper correspondence may still do so.

Step Two: IRS Starts Paperless Processing for Tax Returns in Filing Season 2025.

In this phase, the IRS takes aim at the avalanche of paper it receives, whether tax forms or correspondence.

The agency timeline calls for all paper-filed tax and information returns to be digitally processed on arrival. Half of all non-tax forms, notice responses and other correspondence should start being digitally processed by this period, with full digital processing in place in a year’s time. Once in place, digital processing will also enable up to a billion historical documents – filed tax returns and other files – to be digitized, freeing up millions of dollars in storage costs.

Also, in this step, an additional 150 of the most-used non-tax forms will be available in digital form and optimized for mobile devices. This reflects the move by the IRS to make more of the most popular forms available for smartphones as the they estimate that some 15% of Americans rely on their phones for main internet access, and do not have broadband at home.

IRS: Digital Processing Key to Agency’s Future.

The benefits of paperless processing are huge. First, it stands to speed up customer service by making filed returns and other information available digitally, reducing the possibility of human error in data entry as well as granting customer service representatives improved access to information for addressing taxpayer questions. Taxpayers could expect to see their refunds sooner, since all the data and tax forms will be processed faster. Finally, successful implementation could also have financial rewards from lower paper storage costs, which can be leveraged into other technical improvements within the IRS.

– Article provided by Taxing Subjects.

by Taxing Subjects | Jul 19, 2023 | Tax Tips and News

A key Internal Revenue Service advisory committee has issued its recommendations for 2023, in an effort to keep the IRS – and Congress – on point with improvements to the nation’s income tax filing system.

The Electronic Tax Administration Advisory Committee (ETAAC) is chaired by Jared Ballew, Vice President of Government Relations at Taxwell Representing Drake Software and TaxAct. ETAAC’s just-released annual report carries 26 recommendations aimed at improving electronic tax filing.

Of the 26 items on the committee’s action list, 21 are aimed at the IRS, three are addressed to both the IRS and Congress, and two are meant for Congress.

Some of the 2023 recommendations have their roots in previous ETAAC reports, such as the appeals to Congress to provide timely tax legislation and to pass consistent funding packages for IRS operations and administration.

Other recommendations, meanwhile, look to the future, asking the IRS to make modernization of their processes and equipment a priority, along with improving its online search engines.

Some of the remaining recommendations include:

- Making the IRS’ expansion of the Online Account toolset a priority.

- Prioritizing e-filing of 94X returns and improving processing of duplicate 94X returns.

- Updating Form 1099-K (and its education materials) to allow for easy compliance.

- Making tax information documents available digitally in real-time, so taxpayers can easily export tax data into third-party software.

- Speeding up processing of returns, whether electronically filed or paper.

- Asking the IRS and Congress to do more to regulate paid tax preparers and take steps in the areas of incompetent or unscrupulous conduct.

- Stressing the IRS should come up with ways to deal with higher attrition of its workforce and increasing demands for customer service.

- Asking the IRS to provide timely guidance on federal and state laws that can have an impact on tax administration.

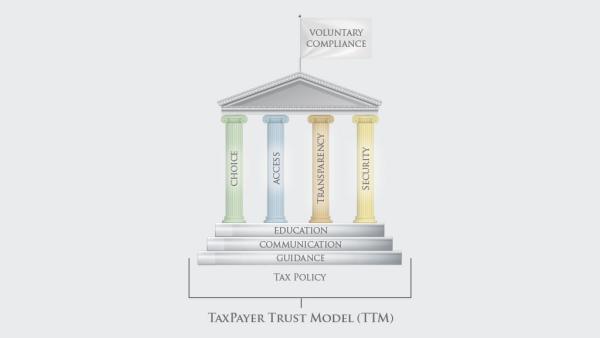

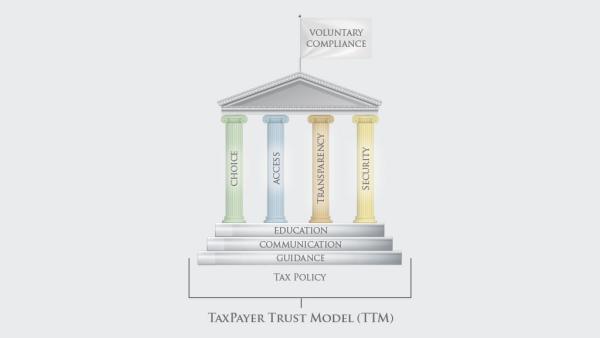

An introductory letter in ETAAC’s 84-page Report to Congress says the committee worked hard to present a report that was balanced yet comprehensive. It uses what the committee calls “the taxpayer’s journey” to describe the various facets of the income tax process. ETAAC also developed a new model to aid in decision-making processes for both policymakers and tax administrators.

“ETAAC has established the Taxpayer Trust Model (TTM) in an effort to standardize, build and maintain high levels of trust in the tax system and to increase compliance. We believe the TTM framework can serve legislators, tax administrators, and stakeholders in their decision-making processes.”

The report also notes that a number of recommendations made in the committee’s previous 2022 report remain unrealized and are still in need of action from the IRS as well as Congress.

The members of ETAAC come from sectors throughout the tax community, representing individual and business taxpayers, tax professionals and preparers, tax software developers, providers of payroll services, the financial industry and state and local governments.

The committee frequently works with the Security Summit, which is a panel made up of IRS officials, state taxing agency representatives and tax industry partners all working together to fight tax-related identity theft and other cybercrimes.

– Article provided by Taxing Subjects.

by Taxing Subjects | Jun 13, 2023 | Tax Tips and News

Weeks of record flooding and mountain snows brought on by an “atmospheric river” in California resulted in a federal disaster declaration from the Federal Emergency Management Agency (FEMA). While disaster victims received tax relief from filing and payment deadlines, some were confused after receiving notices from the Internal Revenue Service.

Why are California disaster victims confused?

When taxpayers fail to pay federal tax due by the deadline, the IRS is required by law to generate a Notice CP14 mailout telling recipients they have 21 days to resolve their balance. Some California disaster victims were reportedly confused after receiving the notice, believing they had additional time to file returns and pay any tax due.

(Spoiler: they do.)

While disaster victims did receive Notice CP14, the IRS noted in a recent statement that the mailings also included a special insert reminding these taxpayers that the previously issued tax relief still applies. However, the agency apologized for the confusion, stressing that storm victims who received the Notice do not need to contact the IRS or their trusted tax professional.

How can I learn more about IRS notices and installment arrangements?

DrakeCPE provides courses covering a variety of tax topics, including two that can help tax professionals better serve clients who have received IRS notices or are unable to pay all taxes owed in one lump sum:

For information about available courses, visit DrakeCPE.com.

Source: IRS statement on California mailing of balance due notices

– Article provided by Taxing Subjects.

by Taxing Subjects | Jun 8, 2023 | Tax Tips and News

A new wave of advertising is churning up interest in a tax credit intended to help businesses and non-profits that tried to retain their employees during the COVID-19 pandemic. However, the ads on TV and radio, online, and even direct mail leave out a critical fact: most of the promoters’ clients won’t qualify for the credit.

That’s where you come in.

As a trusted tax professional, you are often the source of truth for your clients. You may be getting questions about ads touting big payoffs for claiming the Employee Retention Credit (ERC). If these stories sound too good to be true, that’s because they are.

We want you to have all the facts, so your clients can make the right decisions.

Be wary of unrealistic claims for the ERC

To hear one of these ads, you’d think virtually anyone can claim the ERC: businesses, non-profits and individuals alike. In addition, they say “you have nothing to lose!” Both these statements are false.

True, the ERC is a refundable credit, but it is intended for businesses that continued to pay workers even while they were shut down during the pandemic. The credit also applies to businesses that had significant declines in gross receipts during the specified eligibility periods. And no matter what the ads say, individuals are not eligible for the ERC.

As far as filers having “nothing to lose,” consider that anyone who improperly claims the ERC has to pay it back—many times along with penalties and interest. The IRS cautions businesses and tax-exempt organizations that they could find themselves in a much worse cash position if they have to pay back the credit than if they never claimed it in the first place.

What are the requirements for claiming the ERC?

Companies can claim the credit on an original or amended employment tax return for qualified wages paid between March 13, 2020, and Dec. 31, 2021.

To be eligible, employers must have:

- Carried out a full or partial shutdown of operations as ordered by an appropriate governmental authority because of Covid-19 during 2020 or the first three quarters of 2021;

- Experienced a significant decline in gross receipts during 2020 or during the first three quarters of 2021, or;

- Qualified as a recovery startup business for the third or fourth quarters of 2021.

How can clients know if an offer could be a scam?

First, the offer comes through an advertisement or an unsolicited phone call. Either may promote an “easy application process.”

Second, promoters will often claim they can determine the filer’s ERC eligibility within minutes, but charge a large up-front fee just to claim the credit. Many times, promoters will claim a business qualifies for the credit without any discussion of the client’s tax situation.

Finally, promoters’ fees tend to be based on the amount of ERC being claimed.

You are the best defense against ERC scams

The IRS says you, the trusted tax professional, have the skills needed to correctly determine eligibility for the Employee Retention Credit and to calculate the correct credit amount. These third-party promoters have only profit as their motive and cannot be trusted to act in taxpayers’ best interests.

To report abuse of the Employee Retention Credit, submit a Form 14242, Report Suspected Abusive Tax Promotions or Preparers, mailing or faxing the completed form along with any supporting materials to the IRS Lead Development Center in the Office of Promoter Investigations at:

Internal Revenue Service Lead Development Center

Stop MS5040

24000 Avila Road

Laguna Niguel, California 92677-3405

Fax: 877-477-9135

Source: IR-2023-105

– Article provided by Taxing Subjects.

by Taxing Subjects | May 25, 2023 | Tax Tips and News

The Internal Revenue Service is moving ahead with a program that will offer taxpayers a new option for filing their 2023 returns next year. Dubbed “Direct File,” a scaled-down version of the full program will allow taxpayers to file online for free, using an IRS-run website.

The move to online filing through the IRS is rooted in the Inflation Reduction Act (IRA). The IRA mandated that the Treasury Department and the IRS look into whether free online filing is possible through the IRS and what the agency needs to make it happen.

The IRS broke its fact-finding effort into three pieces.

1. Do taxpayers want it?

A number of sources were united to acquire and analyze public opinion about the project. The IRS used its Taxpayer Experience Survey (TES) to poll thousands of taxpayers on the issue. Next, results from an independent MITRE Corporation survey were pulled in. Then, independent analysis by New America and Professor Ariel Jurow Kleiman on the concept was added to the mix.

An IRS report to Congress on the Direct File initiative determined taxpayer interest in the project is sufficient to move forward.

2. Are there costs to implementing Direct File?

While the IRS report doesn’t give hard figures, it does caution Congress that building and executing an effective Direct File online filing site would require a sustained investment by lawmakers. Given the difficulty the agency has faced in receiving requested funding, this could prove to be a roadblock for the future of the program.

3. Is a free online filing portal even possible for the IRS?

The congressional report says creating a successful online filing portal is feasible despite presenting technical challenges for operation and administration. According to the report, the agency is ready and able to meet these challenges.

The IRS is embracing a proven method of testing for its new project: start small and work your way up. To that end, the agency intends to field its Direct File pilot program in 2024 with a limited scope so technicians can more easily track its operation. This approach will also allow system administrators to see if the pilot project adequately meets the customer support and technology needs of taxpayers before the system is scaled up.

In the short term, the IRS plans to meet with stakeholders in the tax industry over the coming months to hear concerns and offer some answers. According to the agency, more details on the Direct File program will soon be available.

Source: IRS submits Direct File report to Congress; Treasury Department directs pilot to evaluate key issues

– Article provided by Taxing Subjects.