by Taxing Subjects | Mar 27, 2023 | Tax Tips and News

The IRS recently published a tax tip explaining Form 1099-K, covering why taxpayers receive it, how to address incorrect forms, and recent updates to reporting rules. This update comes almost three weeks after reports emerged that some taxpayers received incorrect forms.

What is Form 1099-K?

The 1099-K is an information form detailing business transaction payments collected using payment cards and third-party settlement organizations. According to the IRS, the following list includes reasons why a taxpayer might receive the form:

- A business the taxpayer owns

- Self-employment

- Activities in the gig economy

- The sale of personal items and assets

Businesses that routinely accept fees via payment card or platforms like e-Bay, Venmo, and PayPal are used to seeing Forms 1099-K every year. However, the American Rescue Plan of 2021 significantly lowered the reporting threshold from $20,000 and 200 transactions to just $600. In other words, there will be a dramatic increase in the number of people who receive the form.

Why are some taxpayers incorrectly being sent Form 1099-K?

In December 2022, the Internal Revenue Service announced they are delaying implementation of the new 1099-K reporting threshold until tax year 2023—which would affect next year’s tax returns. Despite this development, news organizations are reporting that taxpayers are receiving forms this year, resulting in confusion ahead of the filing deadline.

For their part, the businesses sending forms to taxpayers who meet the updated ARP reporting threshold say they are trying to get a head start on identifying legitimate recipients. Unfortunately, taxpayers whose friends incorrectly coded money transfers as business transactions are seeing incorrect information on their 1099.

What should taxpayers do if they receive an incorrect Form 1099-K?

The IRS recommends that taxpayers who receive an incorrect Form 1099-K contact the issuing company as soon as possible. The agency outlines a few scenarios that could lead to an incorrect form:

- Some taxpayers may have received a Form 1099-K for the sale of personal items

- Form 1099-K may have been issued in error—such as for transactions between friends and family, or expense sharing

If the taxpayer and third-party settlement organization cannot resolve the issue, the IRS recommends reviewing Understanding Your Form 1099-K.

How can I learn more about helping clients with their 1099-K?

The Drake Software Education Team routinely produces free informational videos covering myriad topics, from Drake Tax tutorials to tax rules. The Form 1099K video explains how you can help clients improve voluntary tax compliance when reporting payment card and third-party network transactions.

Sources: IR-2022-226; IRS Tax Tip 2023-37; “Ticketmaster, PayPal, eBay are hassling customers to report sales amid IRS confusion,” TheHill.com

– Article provided by Taxing Subjects.

by Taxing Subjects | Mar 25, 2023 | Tax Tips and News

Identity theft usually takes center stage during most tax-scam discussions. After all, so much of our personal and professional lives take place online in emails, texts, and direct messages—all of which are ripe targets for phishing attacks. However, not all identity threats are limited to inboxes.

The Internal Revenue Service began its 2023 Dirty Dozen campaign by warning taxpayers about a scam that is being spread through radio and online advertisements. Fraudsters are encouraging ineligible businesses to claim the Employee Retention Credit (ERC) by spreading incorrect eligibility requirements.

How does the ERC scam work?

Taxpayers are generally introduced to the scam in ads promoting easy ERC payouts. Once contacted, these third parties tend to either charge a significant upfront fee or collect a percentage from the employer’s refund—two tactics often utilized by scammers (like ghost preparers).

The scammers might use any of the following methods to convince employers to claim the credit:

- [Inaccurately] explain eligibility for and computation of the credit

- [Suggest] that all employers are eligible without evaluating an employer’s individual circumstances

- [Fail to] inform employers that they cannot claim the ERC on wages that were reported as payroll costs in obtaining Paycheck Protection Program loan forgiveness

In addition to causing a headache for legitimate tax professionals dealing with duped business clients, the ERC scam could result in penalties—civil and criminal—and identity theft.

What is the legitimate method for claiming the ERC?

The Employee Retention Credit was created to help qualifying businesses weather pandemic-related shutdowns from March 13, 2020, to December 31, 2021—providing refundable tax credits for continuing to pay employees or experiencing a reduction in gross receipts during that period. So, to claim the ERC, employers need to meet the following criteria:

For more information about credit eligibility, check out Notice 2021-20, Notice 2021-23, Notice 2021-49, Notice 2021-65, and Revenue Procedure 2021-33.

What should employers do if they were convinced to participate in the ERC scam?

The IRS suggests that employers who participated in the ERC scam should immediately file an amended return. The agency reminds that “taxpayers are always responsible for the information reported on their tax returns,” and “improperly claiming the ERC could result in taxpayers being required to repay the credit along with penalties and interest.”

Sources: IR-2023-49; IR-2022-183

– Article provided by Taxing Subjects.

by Taxing Subjects | Mar 21, 2023 | Tax Tips and News

New technology could improve tax return processing time at the IRS

Paper returns have historically been slower to process due to the Internal Revenue Service having to manually transcribe information, leading taxpayers who want to more quickly receive their refund to electronically file. However, there could be a light at the end of the tunnel for those who either prefer or are required to file paper returns.

This year, the IRS launched the Digital Intake scanning initiative as part of its push to improve the service it provides to everyone, from taxpayers and businesses to members of the tax industry. As part of the initiative, the agency is deploying new scanning technology to more quickly convert scanned paper tax returns into digital files.

“The IRS has been using various technologies to scan tax returns for more than 35 years but recently took a leap forward by leveraging cutting-edge technologies via a revolutionary procurement approach to test their effectiveness,” the IRS explains. “The capabilities enable the IRS to digitalize more paper for downstream processing and storage, resulting in greater efficiencies and improved data management outcomes.”

Currently, the initiative involves Lockbox Financial Agent banks and contracted industry partners.

How is the Digital Intake initiative going?

The IRS says they have already scanned more than 120,000 Forms 940 since the year began: roughly twenty times more than all the documents scanned last year. As a result, they have also earmarked Forms 1040 and 941 for the initiative.

This early inclusion of individual income and employer quarterly tax forms could signal that the program will be successful. Ultimately, the shift to efficient, accurate digital conversion tools would facilitate electronic processing and storage for paper filings, reducing turnaround time for these returns.

IRS Chief Information Officer Nancy Sieger shared her optimism about the program: “technology powers tax administration, and we have completed important work over the last year to help people get the assistance they need and reduce paper, in addition to improving the agency’s underlying technology infrastructure. This is another positive step in the future technology direction for the IRS that includes improving service to taxpayers.”

Source: IR-2023-41

– Article provided by Taxing Subjects.

by Taxing Subjects | Mar 9, 2023 | Tax Tips and News

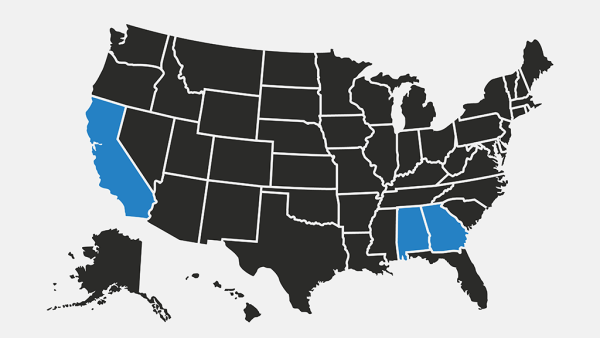

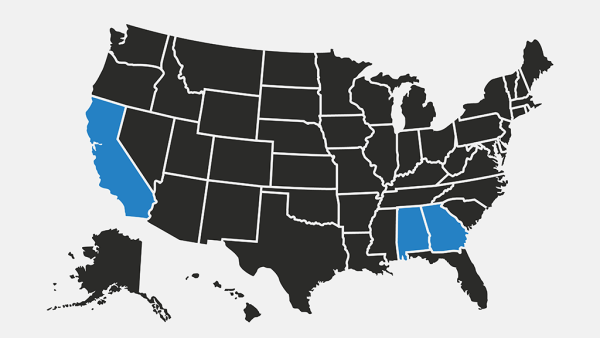

The Internal Revenue Service recently extended tax relief for disaster victims in Alabama, California, and Georgia. Individuals and businesses in these federally declared disaster areas now have until October 16, 2023, to meet several filing and payment deadlines.

Which filing and payment deadlines are extended by this tax relief?

The tax relief provided to disaster victims in Alabama, California, and Georgia affects a number of deadlines, including:

- January 17: fourth quarter 2022 estimated tax payments

- January 31: quarterly payroll and excise tax returns

- March 1: farmer returns for those who forgo estimated tax payments

- March 15: various business returns

- April 18: individual income tax returns

- April 18: various business returns

- April 18: estimated tax payments

- April 30: quarterly payroll and excise tax returns

- May 15: tax-exempt organization returns

- June 15: estimated tax payments

- July 31: quarterly payroll and excise tax returns

- September 15: estimated tax payments

Additionally, uninsured and unreimbursed losses resulting from these disasters can be “[claimed] on either the return for the year the loss occurred or the return for the prior year.”

Can anyone else qualify for this tax relief?

Taxpayers living outside disaster areas can also receive this tax relief if they meet specific requirements, like storing deadline-relevant records or serving as relief workers for a “recognized government or philanthropic organization” in those locations. The IRS directs these individuals to call 866-562-5227 to learn more about potentially qualifying.

Where can I learn more about this tax relief?

The following resources contain more information about affected deadlines and claiming uninsured or unreimbursed losses, respectively:

If you’re interested in earning CPE while learning to serve clients affected by a disaster, check out our new Federally Declared Disasters course on DrakeCPE.com. This course will teach you to determine filer eligibility, identify casualty losses, and prove, figure, and report gains and losses.

Source: IR-2023-33

– Article provided by Taxing Subjects.

by Taxing Subjects | Mar 8, 2023 | Tax Tips and News

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court held that the penalty for nonwillful failure to file an FBAR should be assessed on a per-report basis—capping fines at $10,000 per year, regardless of the number of accounts.

Which foreign accounts should taxpayers include in FBAR?

The Bank Secrecy Act (BSA) requires that taxpayers report foreign accounts in which they hold a financial interest, including:

One type of financial account is conspicuous by its absence: FBAR does not currently apply to accounts exclusively holding virtual currency. However, the Financial Crimes Enforcement Network (FinCEN) has already announced its intention to propose regulations that would “include virtual currency as a type of reportable account under 31 CFR 1010.350” (FinCEN Notice 2020-2).

Why did SCOTUS issue this ruling?

The majority opinion argues that the government’s per-account method for calculating nonwillful FBAR fines is not supported by statute, Treasury guidance, or Congressional statement of purpose (5-9, 11). They note that these examples actually serve as evidence for determining nonwillful fines on a per-report basis, including the following:

- “Section 5314 provides that the Secretary of the Treasury ‘shall’ require certain persons to ‘keep records, file reports, or keep records and file reports’ when they ‘mak[e] a transaction or maintai[n] a relation’ with a ‘foreign financial agency’”

- “Section 5321 authorizes the Secretary to impose a civil penalty of up to $10,000 for ‘any violation’ of Section 5314”

- “In 2010, the Department of the Treasury issued a notice of proposed rulemaking warning that, under its proposed rules, ‘[a] person who is required to file an FBAR and fails to properly file may be subject to a civil penalty not to exceed $10,000’”

- “Instructions included with the FBAR form have cautioned that ‘[a] person who is required to file an FBAR and fails to properly file may be subject to a civil penalty not to exceed $10,000’”

- “Congress has declared that the BSA’s ‘purpose’ is ‘to require’ certain ‘reports’ or ‘records’ that may assist the government in everything from criminal and tax to intelligence and counterintelligence investigations”

Since there is no mention of per-account fines for nonwillful violations—and many government documents instead indicate per-report fines—the Court ultimately sided with Bittner, reaffirming that penalties should be clearly stated in “language that the common world will understand” (15).

How can I learn more about FBAR?

We offer a new course on DrakeCPE.com dedicated to teaching paid tax return preparers about reporting foreign financial accounts. After completing Reporting Foreign Financial Accounts: FinCEN and FBAR, you will know what led to the creation of FBAR and how to meet relevant preparation and filing guidelines.

Source: Bittner v. United States, No. 21-1195 (2023)

– Article provided by Taxing Subjects.